How Pungo Engineered Citcon's Developer Platform into a Global Payment Integration Hub

Overview

In today’s API-first economy, developer experience can define the trajectory of an entire platform. For Citcon—a global leader in digital payment orchestration—developer.citcon.com needed to do more than just deliver documentation. It had to empower developers to integrate complex, cross-border payment infrastructure quickly, securely, and with confidence.

That’s where Pungo came in.

As a digital transformation partner with deep experience in FinTech and payment architecture, Pungo collaborated with Citcon to architect, design, and develop a robust developer portal that now anchors Citcon’s global API ecosystem. From seamless API onboarding to SDK documentation and sandbox test flows, our focus was to reduce friction and accelerate time-to-integration across mobile, web, and in-store use cases.

The Challenge: Developer Friction in a Fragmented Payment Landscape

Citcon’s platform offers a rich suite of payment options—from Alipay and WeChat Pay to Visa, Mastercard, and regional wallets like Dana, GCash, and JkoPay. But without a unified developer experience, merchants often struggled with:

-

Unclear API usage patterns

-

Inconsistent documentation across SDKs

-

Security ambiguity around PCI and tokenization

-

Painfully slow onboarding due to lack of self-service tools

Citcon needed a solution that would scale globally but feel local to every developer.

Pungo’s Solution: Build a Platform, Not Just a Portal

Pungo approached the project not as a static documentation site, but as a developer enablement platform. We focused on three pillars:

1. Modular Architecture with Future-Ready SDK Support

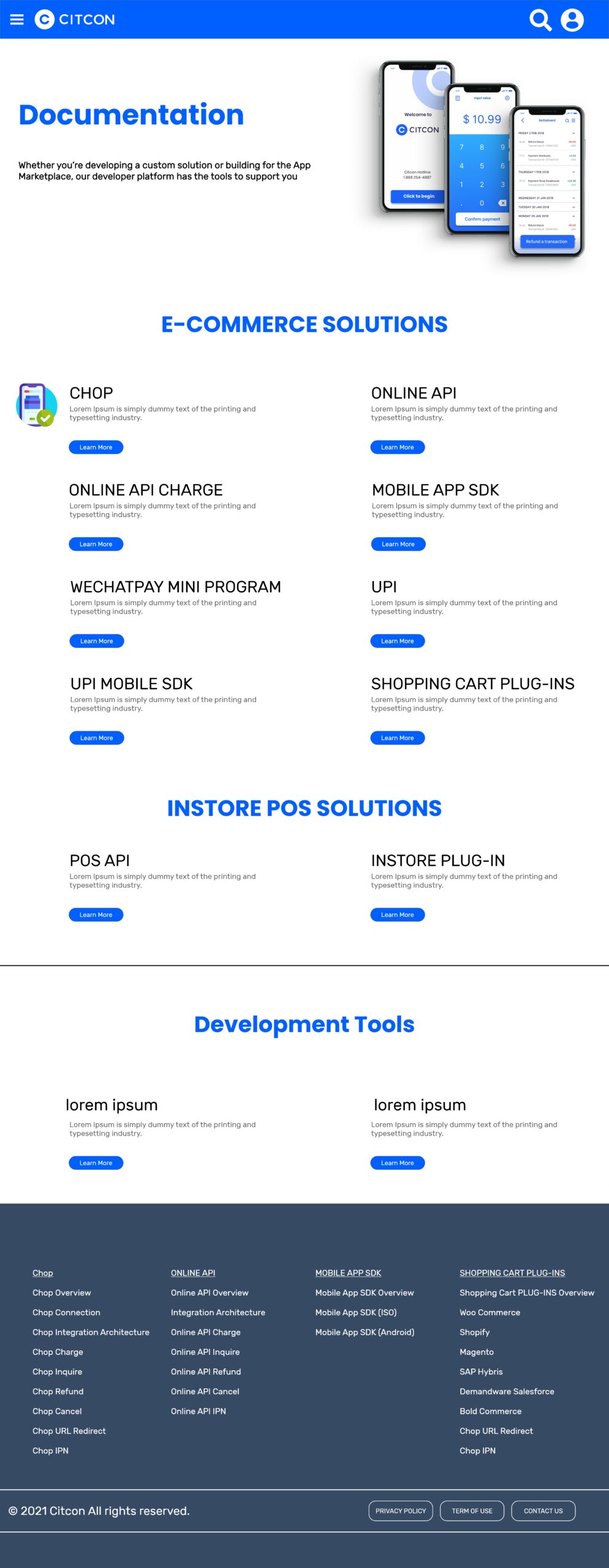

We implemented a modular documentation framework, covering:

-

CHOP: Citcon Hosted Online Payment for quick PCI-reduced integrations

-

UPI (Universal Program Interface): For full customizability via backend APIs

-

POS & InStore APIs: For merchants needing in-store hardware integration

-

Mobile SDKs: iOS and Android SDKs with example use cases and test data

-

E-Commerce Cart Plugins: Like Shopify, Magento, and WooCommerce compatibility

Developers can easily find what fits their use case, plug in test credentials, and start building in minutes.

2. Dynamic Sandbox & Credential Flow

We enabled sandbox registration with token generation and self-service testing endpoints. This empowered merchants to simulate transactions with:

-

QR Code generation (desktop/mobile)

-

Mobile-native redirection flows

-

Refund, charge, and capture transactions

-

Tokenization and vault support for recurring billing and subscriptions

3. Developer-Centric UI/UX

Beyond API specs, we prioritized usability:

-

A clean sign-up/login flow with PCI agreement management

-

Clear, role-based onboarding (e.g., CEO, Developer, Integrator)

-

Smart UI elements for code snippets, curl commands, and test payloads

-

“Learn More” callouts for deep dives into complex modules like WeChat Mini Programs or Chinese Customs APIs

The result? Developers feel like they’re in control. And more importantly, they trust the integration process.

Impact: From Friction to Fulfillment

Since the launch of developer.citcon.com, Citcon has seen:

-

A reduction in support tickets related to integration errors

-

Faster go-lives with enterprise merchants and platform partners

-

Stronger partnerships with shopping cart providers and POS vendors

-

Improved perception of Citcon’s brand as a tech-first payment provider

Why Pungo?

This project is a showcase of what Pungo does best: bridging the technical with the business-critical. We don’t just write code—we build ecosystems. Whether you’re a FinTech, SaaS platform, or global retailer, Pungo delivers scalable solutions that feel custom.

Next Step: Let’s Build Together

Want to build a next-gen developer experience like Citcon?

📩 Or email us directly at info@pungo.ca

developer.citcon.com isn’t just a portal. It’s proof that developer experience is product experience. And it’s why Pungo remains the trusted partner behind some of the most ambitious digital transformations in the payments industry.